Are you tired of juggling spreadsheets and losing track of your finances? This Budget Planner Sync App review dives into a solution designed to simplify your money management. We'll explore its features, ease of use, and overall effectiveness in helping you master your budget. Discover how seamless syncing, insightful reports, and intuitive design can transform your financial planning. Let's see if this app lives up to the hype!

Step-by-Step Instructions

-

App Introduction

- Introduction to Budget Planner Sync app - a $299 finance app.

-

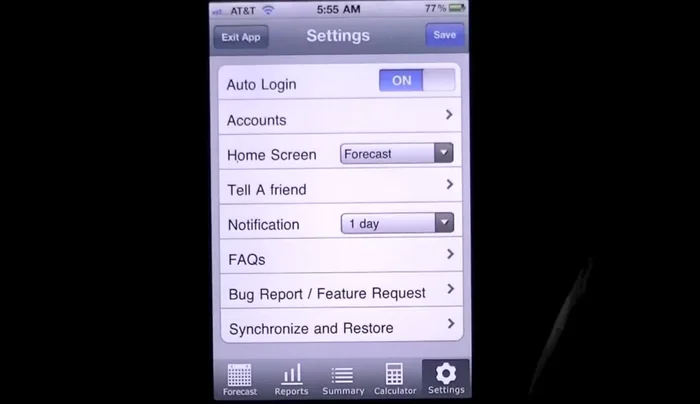

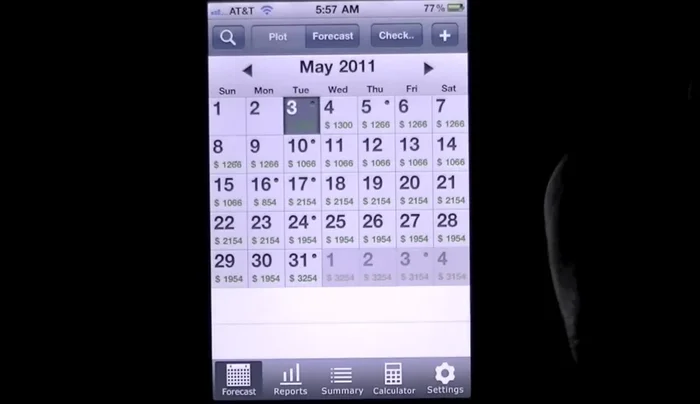

Home Screen Customization and Overview

- Access the main screen and customize the home screen view (forecast, calendar, spreadsheets, budget, loan calculator, tip calculator).

- Use the forecast view to monitor financial overview.

Home Screen Customization and Overview -

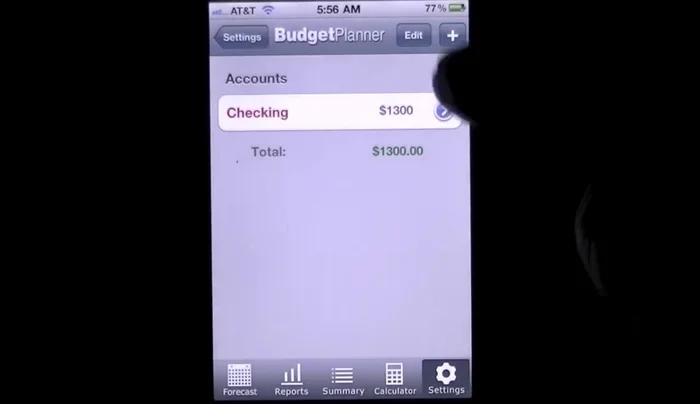

Account Management

- Add, name, and manage multiple accounts.

Account Management -

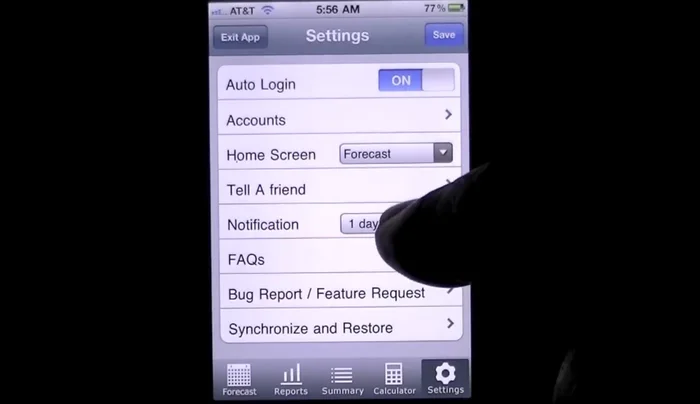

Notification Setup

- Set up notifications for bill due dates.

Notification Setup -

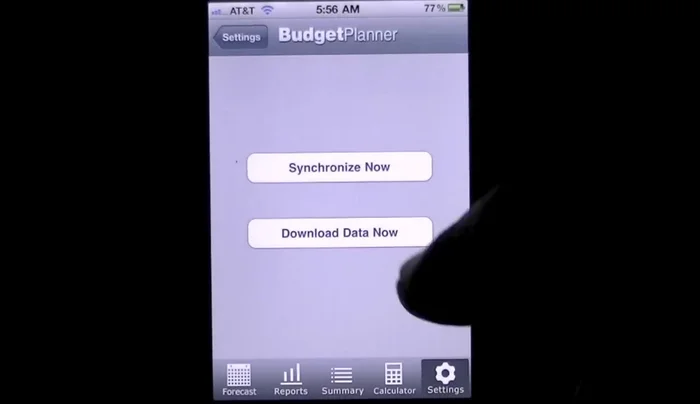

Data Synchronization

- Synchronize and restore data across devices.

Data Synchronization -

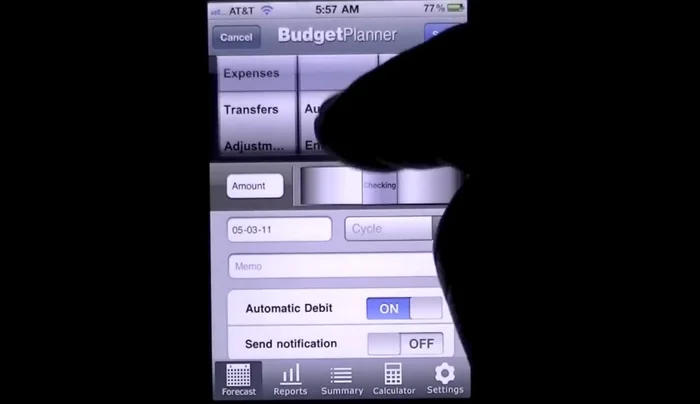

Adding Income/Expenses

- Add income or expenses quickly and easily. Specify details like category (e.g., gas), amount, recurrence (weekly, etc.), and optional automatic debit and notifications.

Adding Income/Expenses -

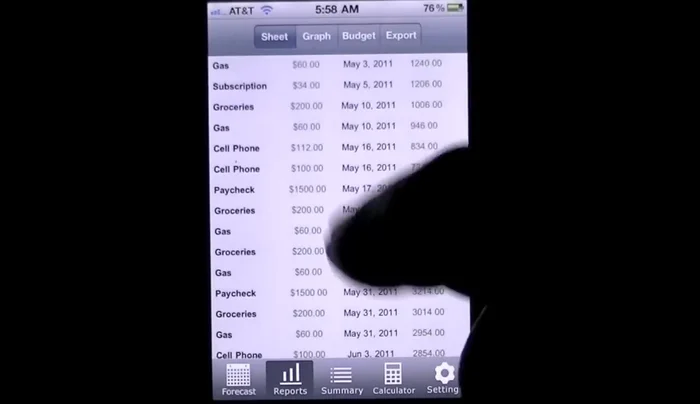

Reviewing and Managing Transactions

- View expenses categorized by month, week, or day. Edit or delete entries as needed.

Reviewing and Managing Transactions -

Report Generation

- View data in sheet, graph (pie chart) and budget formats. Customize graph time range.

Report Generation -

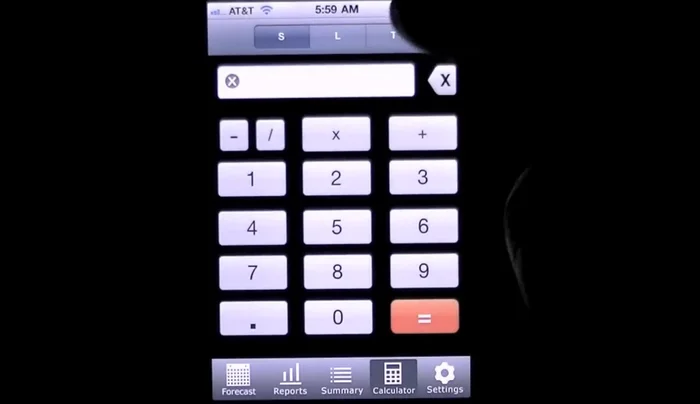

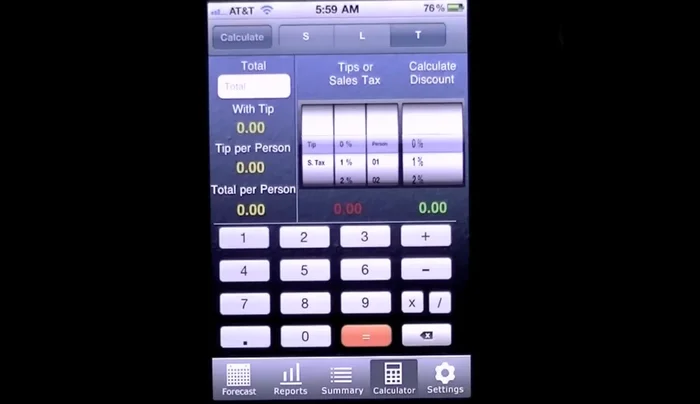

Calculator Usage

- Regular, loan, and tip calculators.

Calculator Usage -

Subscription Details

- Explore subscription options for syncing across multiple devices ($3.99 for 3 months or ~$10 for a year).

Subscription Details

Tips

- Customize your home screen for quick access to your preferred view.

- Utilize automatic debit and notifications for recurring expenses to stay organized.

- Use the graph reports for a visual representation of your spending habits.

- Consider the subscription option for syncing across multiple devices for enhanced convenience.

Common Mistakes to Avoid

1. Inconsistent Data Entry

Reason: Forgetting to log transactions regularly or entering information inaccurately leads to inaccurate budget projections and analysis.

Solution: Establish a daily or weekly habit of logging transactions immediately, and double-check entries for accuracy.

2. Unrealistic Budgeting

Reason: Setting overly ambitious or restrictive budget goals leads to frustration and eventual abandonment of the budgeting process.

Solution: Create a budget that’s both challenging and attainable by carefully tracking spending habits for a few months and setting realistic goals.

3. Ignoring the 'Big Picture'

Reason: Focusing only on small expenses and neglecting larger financial goals like savings or debt reduction prevents effective long-term financial planning.

Solution: Integrate your larger financial objectives into your budget to ensure they're addressed systematically.

FAQs

Is my data safe with this budget planner app?

Most reputable budget planner apps use robust security measures like encryption to protect your financial data. Look for apps that clearly state their security policies and comply with relevant data privacy regulations. Check reviews to see what users say about the app's security.

How much does the app cost, and are there any hidden fees?

Pricing varies widely. Some apps offer free versions with limited features, while others charge a monthly or annual subscription. Always check the app store listing for detailed pricing information and look for any mention of in-app purchases or additional fees before downloading.

Can I sync my data across multiple devices (phone, tablet, computer)?

Many budget planner apps offer cross-device syncing, allowing you to access your budget information from anywhere. Look for features like cloud syncing or account linking in the app description. Confirm that the app supports your preferred devices.